Benton County Tax Collector AR: A Comprehensive Guide

Are you a resident of Benton County, Arkansas, or someone looking to understand the tax collection process in the area? Look no further. This article delves into the role, responsibilities, and services offered by the Benton County Tax Collector in Arkansas. Whether you’re a homeowner, business owner, or simply curious about the tax collection process, this guide will provide you with all the necessary information.

Understanding the Role of the Benton County Tax Collector

The Benton County Tax Collector is an essential government official responsible for collecting property taxes, motor vehicle taxes, and other fees in Benton County. The tax collector ensures that the county receives the necessary funds to provide public services and maintain infrastructure. By understanding the role of the tax collector, you can better navigate the tax collection process and ensure compliance with your tax obligations.

Responsibilities of the Benton County Tax Collector

The Benton County Tax Collector has several key responsibilities, including:

-

Collecting property taxes: The tax collector is responsible for assessing and collecting property taxes from homeowners and businesses in Benton County.

-

Motor vehicle taxes: The tax collector also collects motor vehicle taxes, including registration fees and other related charges.

-

Administering tax delinquency: If taxes are not paid on time, the tax collector is responsible for administering delinquency penalties and pursuing collection efforts.

-

Reporting to the county: The tax collector provides regular reports to the Benton County government on tax collection activities and financial status.

Services Offered by the Benton County Tax Collector

The Benton County Tax Collector offers a range of services to residents and businesses, including:

-

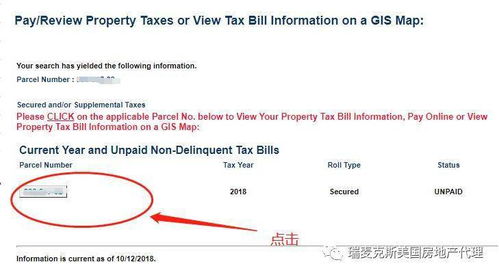

Online tax payment: The tax collector’s website allows residents and businesses to pay property taxes, motor vehicle taxes, and other fees online, providing convenience and ease of access.

-

Payment plans: For those unable to pay their taxes in full, the tax collector offers payment plans to help manage tax obligations.

-

Property tax information: The tax collector provides detailed information on property tax assessments, including property values and tax rates.

-

Motor vehicle tax information: The tax collector offers information on motor vehicle taxes, including registration fees and other related charges.

How to Pay Your Taxes

Paying your taxes is an important responsibility, and the Benton County Tax Collector makes it easy to comply with your tax obligations. Here’s how you can pay your taxes:

-

Online payment: Visit the Benton County Tax Collector’s website and follow the instructions to pay your taxes online.

-

In-person payment: Visit the Benton County Tax Collector’s office during business hours to pay your taxes in person.

-

By mail: Mail your payment to the Benton County Tax Collector’s office with the appropriate payment stub.

Understanding Property Tax Assessments

Property tax assessments are an important aspect of the tax collection process. Here’s what you need to know about property tax assessments in Benton County:

-

Assessment process: The Benton County Assessor’s Office is responsible for assessing property values in the county. The assessment process involves evaluating the property’s value based on factors such as size, location, and condition.

-

Assessment appeals: If you believe your property’s assessment is incorrect, you can file an appeal with the Benton County Assessor’s Office.

-

Assessment notices: The Benton County Assessor’s Office sends out assessment notices to property owners, detailing the assessed value and tax amount.

Motor Vehicle Taxes

Motor vehicle taxes are another important aspect of the tax collection process. Here’s what you need to know about motor vehicle taxes in Benton County:

-

Registration fees: Motor vehicle taxes include registration fees, which are paid when you register your vehicle in Benton County.

-

Renewal fees: You must renew your vehicle registration annually and pay the associated motor vehicle taxes.

-

Vehicle tax information: The Benton County Tax Collector’s office provides information on motor vehicle taxes, including registration fees and other related charges.