Forecasting an AR(1) Process: A Detailed Guide

Understanding and forecasting time series data is a crucial skill in various fields, from finance to economics. One of the simplest and most widely used models for time series forecasting is the Autoregressive (AR) model, specifically the AR(1) process. In this article, we will delve into the intricacies of forecasting an AR(1) process, providing you with a comprehensive understanding of its application and implementation.

What is an AR(1) Process?

An AR(1) process, also known as a first-order autoregressive model, is a time series model that uses the current value of the series as a linear combination of its past values. The model is defined by the following equation:

| Equation | Description |

|---|---|

| Y_t = c + phi Y_{t-1} + epsilon_t | Where Y_t is the current value, c is the constant term, phi is the autoregressive coefficient, Y_{t-1} is the previous value, and epsilon_t is the error term. |

The autoregressive coefficient phi determines the degree of similarity between the current value and its past value. A value close to 1 indicates a strong relationship, while a value close to 0 suggests a weak relationship.

Characteristics of an AR(1) Process

Here are some key characteristics of an AR(1) process:

-

Stationarity: An AR(1) process is a stationary process, meaning that its statistical properties do not change over time. This is important for accurate forecasting.

-

Linearity: The AR(1) process is linear, which makes it easier to analyze and forecast.

-

Memory: The AR(1) process has memory, meaning that its future values depend on its past values. This is evident in the autoregressive term phi.

Forecasting an AR(1) Process

Forecasting an AR(1) process involves estimating the future values of the series based on its past values. Here are the steps involved:

-

Collect and preprocess the data: Gather the time series data and ensure it is stationary. If the data is not stationary, apply a transformation such as differencing or detrending.

-

Estimate the autoregressive coefficient: Use statistical methods such as the Yule-Walker equation or maximum likelihood estimation to estimate the autoregressive coefficient phi.

-

Forecast the future values: Once you have estimated the autoregressive coefficient, use the AR(1) model to forecast the future values of the series.

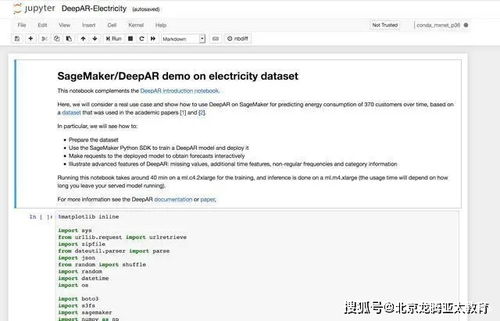

Here is an example of how to forecast an AR(1) process using Python:

import numpy as npimport pandas as pdfrom statsmodels.tsa.ar_model import AutoReg Load the datadata = pd.read_csv('data.csv') Ensure the data is stationarydata_diff = data.diff().dropna() Estimate the autoregressive coefficientmodel = AutoReg(data_diff, lags=1)results = model.fit() Forecast the future valuesforecast = results.predict(start=len(data_diff), end=len(data_diff) + 5) Print the forecastprint(forecast)

Applications of AR(1) Process Forecasting

The AR(1) process has various applications in different fields:

-

Finance: Forecasting stock prices, interest rates, and other financial variables.

-

Economics: Forecasting economic indicators such as GDP, inflation, and unemployment rates.

-

Engineering: Forecasting system performance, such as energy consumption or equipment failure rates.

Conclusion

Forecasting an AR(1) process is a valuable skill in various fields. By understanding the characteristics and steps involved in forecasting an AR(1) process, you can make more accurate predictions and informed decisions. Remember to ensure your data is stationary and to use appropriate statistical methods for estimation and forecasting.