Understanding AR Payment Terms in Oracle Apps R12: A Detailed Guide for Users

Managing accounts receivable (AR) payment terms is a crucial aspect of financial operations in any organization. Oracle Apps R12, being a robust and comprehensive ERP system, offers a variety of features to streamline this process. In this article, we will delve into the intricacies of AR payment terms in Oracle Apps R12, providing you with a comprehensive understanding of how to effectively manage and utilize this feature.

What are AR Payment Terms?

AR payment terms refer to the conditions under which a customer is expected to pay for the goods or services they have received. These terms typically include the due date, payment methods, and any discounts or penalties associated with timely or late payments. In Oracle Apps R12, managing these terms is essential for maintaining healthy cash flow and ensuring accurate financial reporting.

Setting Up AR Payment Terms in Oracle Apps R12

Setting up AR payment terms in Oracle Apps R12 involves several steps. Here’s a detailed guide to help you through the process:

-

Log in to Oracle Apps R12 and navigate to the “Setup” menu.

-

Select “Financials” and then “Receivables” to access the AR setup options.

-

Choose “Payment Terms” and click on “Create” to start the setup process.

-

Enter the payment term name, description, and other relevant details.

-

Define the due date calculation method, such as “Net Days” or “End of Month,” and specify the number of days.

-

Set up any discounts or penalties for early or late payments.

-

Save the payment term and repeat the process for any additional terms you need.

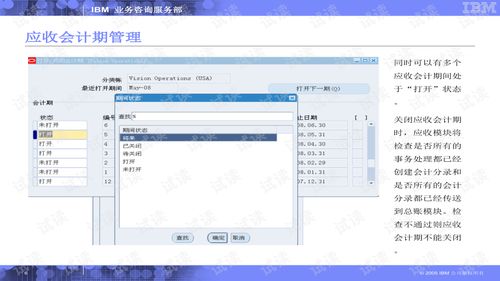

Managing AR Payment Terms

Once you have set up AR payment terms, it’s important to manage them effectively. Here are some key aspects to consider:

-

Updating Payment Terms: As business needs evolve, you may need to update existing payment terms or create new ones. This can be done by navigating to the “Payment Terms” setup screen and making the necessary changes.

-

Assigning Payment Terms to Customers: In Oracle Apps R12, you can assign payment terms to individual customers or customer hierarchies. This ensures that each customer is billed according to their specific terms.

-

Monitoring Payment Terms: Regularly review your AR payment terms to ensure they are still relevant and effective. This may involve analyzing payment trends, customer feedback, and other factors.

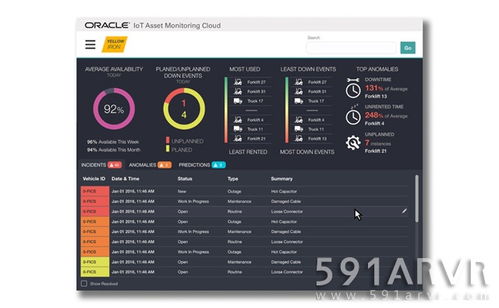

Integrating AR Payment Terms with Other Modules

Oracle Apps R12 is designed to be a fully integrated ERP system. This means that AR payment terms can be easily integrated with other modules, such as Sales, Purchasing, and Inventory. Here are some examples of how this integration can benefit your organization:

-

Sales: When creating a sales order, you can select the appropriate payment term for the customer, ensuring that the order is processed according to their agreed-upon terms.

-

Purchasing: In the purchasing process, you can specify payment terms for suppliers, ensuring that invoices are paid on time and in accordance with the agreed-upon conditions.

-

Inventory: By integrating AR payment terms with inventory management, you can better manage stock levels and ensure that inventory is replenished in a timely manner.

Best Practices for Managing AR Payment Terms

Here are some best practices to help you manage AR payment terms effectively in Oracle Apps R12:

-

Regularly Review and Update Terms: As mentioned earlier, regularly review and update your AR payment terms to ensure they remain relevant and effective.

-

Communicate with Customers: Maintain open lines of communication with your customers regarding payment terms, ensuring they understand their obligations and the consequences of late payments.

-

Utilize Reporting Tools: Take advantage of Oracle Apps R12’s reporting tools to monitor payment trends, identify potential issues, and make data-driven decisions.