Benton County AR Tax Collector: A Comprehensive Guide

Are you a resident of Benton County, Arkansas, and looking for information about the tax collector? Look no further! This article will provide you with a detailed and multi-dimensional introduction to the Benton County AR Tax Collector, ensuring you have all the necessary information at your fingertips.

Understanding the Role of the Tax Collector

The Benton County AR Tax Collector is responsible for the collection of property taxes within the county. This includes the assessment, collection, and distribution of property taxes to various local governments, such as cities, school districts, and other taxing entities. The tax collector plays a crucial role in ensuring that local governments receive the necessary funds to provide essential services to the community.

Services Offered by the Tax Collector

The Benton County AR Tax Collector offers a range of services to residents and property owners. Here are some of the key services provided:

-

Property Tax Assessment: The tax collector assesses the value of properties within the county, which is used to determine the amount of property tax owed.

-

Property Tax Collection: The tax collector is responsible for collecting property taxes from residents and property owners.

-

Delinquent Tax Collection: If property taxes are not paid on time, the tax collector works to collect delinquent taxes, including penalties and interest.

-

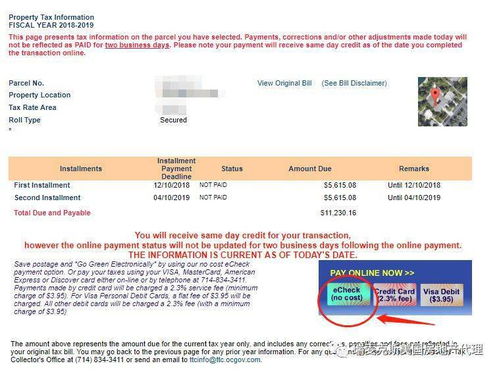

Property Tax Payment Options: The tax collector offers various payment options, including online payment, mail-in payments, and in-person payments.

-

Property Tax Relief Programs: The tax collector provides information about property tax relief programs, such as the Homestead Exemption, which can reduce the amount of property tax owed.

Location and Contact Information

The Benton County AR Tax Collector is located at 215 E Central Ave, Bentonville, AR 72712. You can contact the tax collector’s office by phone at (479) 271-3180 or by email at taxcollector@bentoncounty.org.

Property Tax Payment Options

Payment options for property taxes in Benton County are designed to be convenient and accessible for residents. Here are the available payment methods:

-

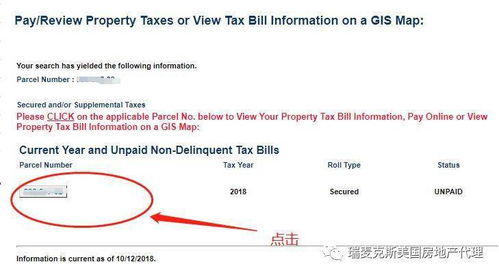

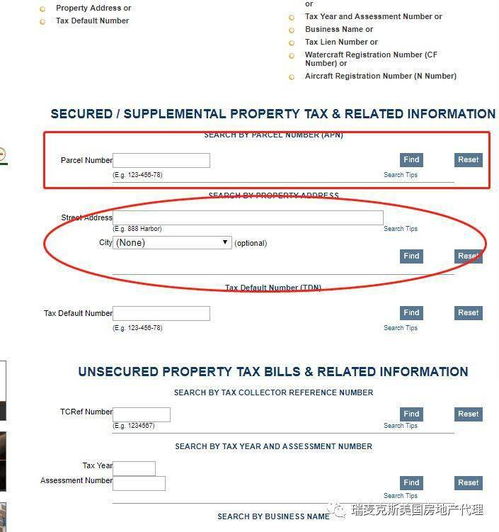

Online Payment: You can pay your property taxes online through the Benton County website. Simply visit the website, log in to your account, and follow the payment instructions.

-

Mail-In Payment: You can mail your payment to the Benton County AR Tax Collector’s office. Be sure to include the payment stub with your payment to ensure proper credit.

-

In-Person Payment: You can pay your property taxes in person at the Benton County AR Tax Collector’s office. The office is open during regular business hours, and you can pay with cash, check, or credit card.

Property Tax Relief Programs

The Benton County AR Tax Collector is committed to helping residents manage their property tax obligations. Here are some of the property tax relief programs available:

-

Homestead Exemption: This program allows eligible homeowners to reduce their property tax liability by a certain percentage. To qualify, you must own and occupy the property as your primary residence.

-

Senior Citizen Exemption: This program provides property tax relief for qualifying senior citizens. To qualify, you must be 65 years of age or older and meet certain income requirements.

-

Disabled Veteran Exemption: This program offers property tax relief for disabled veterans. To qualify, you must be a disabled veteran and meet certain income requirements.

Property Tax Deadlines

It’s important to be aware of property tax deadlines to avoid penalties and interest. Here are the key deadlines:

| Deadline | Description |

|---|---|

| First Half Payment Due Date | Due by December 31st |

| Second Half Payment Due Date | Due by June 30th |

| Delinquent Tax Payment Due Date | Due by January 31

|