What is the Difference Between Invoice and Credit Note in Accounts Receivable?

Understanding the nuances between an invoice and a credit note is crucial for anyone involved in accounts receivable. Both documents play a significant role in financial transactions, but they serve different purposes. Let’s delve into the details to help you differentiate between the two.

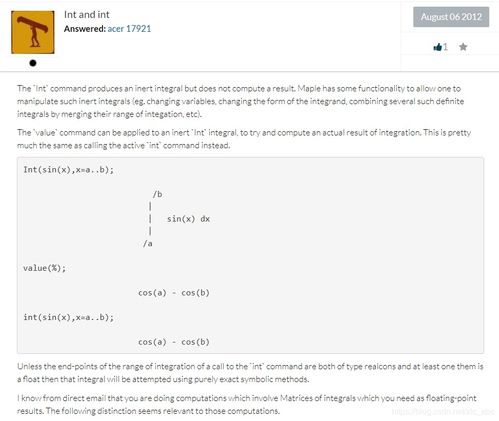

What is an Invoice?

An invoice is a commercial document issued by a seller to a buyer, requesting a payment for goods or services provided. It serves as a formal record of the transaction and outlines the details of the sale, including the quantity of goods sold, the price per unit, and the total amount due.

| Invoice Details | Description |

|---|---|

| Buyer’s Information | Contains the buyer’s name, address, and contact details. |

| Seller’s Information | Contains the seller’s name, address, and contact details. |

| Date of Invoice | Indicates the date when the invoice was issued. |

| Description of Goods/Services | Describes the goods or services provided, including quantity, price per unit, and total amount. |

| Payment Terms | Outlines the payment due date and any applicable discounts or penalties for late payment. |

What is a Credit Note?

A credit note is a document issued by a seller to a buyer, acknowledging a reduction in the amount owed due to various reasons, such as returns, discounts, or errors. It serves as a formal record of the adjustment and is used to update the buyer’s account balance.

| Credit Note Details | Description |

|---|---|

| Buyer’s Information | Contains the buyer’s name, address, and contact details. |

| Seller’s Information | Contains the seller’s name, address, and contact details. |

| Date of Credit Note | Indicates the date when the credit note was issued. |

| Reason for Credit Note | Describes the reason for the credit note, such as returns, discounts, or errors. |

| Original Invoice Number | References the original invoice number to which the credit note applies. |

| Amount of Credit | Indicates the amount of credit granted to the buyer. |

Difference Between Invoice and Credit Note

Now that we have a clear understanding of both documents, let’s explore the key differences between an invoice and a credit note:

- Function: An invoice is used to request payment for goods or services, while a credit note is used to reduce the amount owed.

- Timing: An invoice is issued when goods or services are provided, while a credit note is issued after the transaction has taken place.

- Content: An invoice contains details of the sale, including the quantity, price, and payment terms, while a credit note contains details of the adjustment, such as the reason for the credit and the amount of credit granted.

- Impact on Accounts Receivable: An invoice increases the accounts receivable balance, while a credit note decreases the accounts receivable balance.

Understanding these differences is essential for maintaining accurate financial records and ensuring smooth accounts receivable processes. By recognizing the purpose and function of each document, you can effectively manage your financial transactions and maintain a healthy cash flow.

In conclusion, an invoice and a credit note are both important documents in accounts receivable, but they serve different purposes. An invoice is used to request payment for goods or services, while a credit note is used to reduce the amount owed. By